Market Statistics

May 2024

U.S. existing-home sales fell for the second month in a row, sliding 1.9% monthover-month and 1.9% year-over-year, according to the National Association of REALTORS® (NAR), with sales down in all four regions of the country. Higher borrowing costs and accelerating home prices continue to weigh on demand, pushing some prospective buyers to the sidelines and causing market activity to

slump ahead of summer.

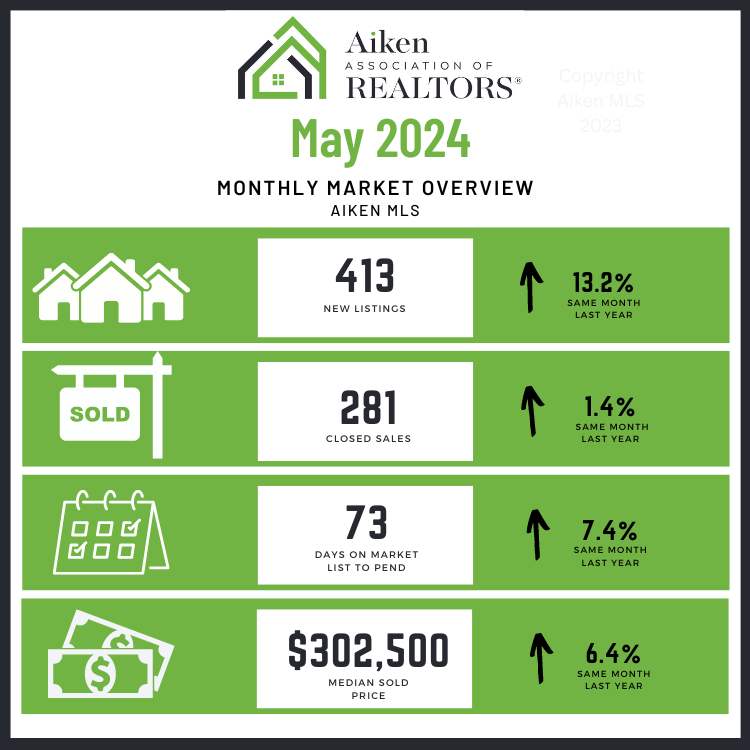

- New Listings were up 13.2 percent to 413.

- Pending Sales decreased 5.9 percent to 301.

- Inventory grew 33.7 percent to 983 units.

- Prices moved higher as Median Sales Price was up 6.4 percent to $302,500.

- Days on Market increased 7.4 percent to 73 days.

- Months Supply of Inventory was up 31.0 percent to 3.8 months, indicating that supply increased relative to demand.

Home prices have continued to climb nationwide, despite an uptick in inventory this year. Nationally, the median existing-home price reached $407,600 as of last measure, a 5.7% increase from the same period last year and a record high for the month, according to NAR. Meanwhile, total inventory heading into May stood at 1.21 million units, a 9% increase month-over-month and a 16.3% increase year-overyear, for a 3.5 month’s supply at the current sales pace.